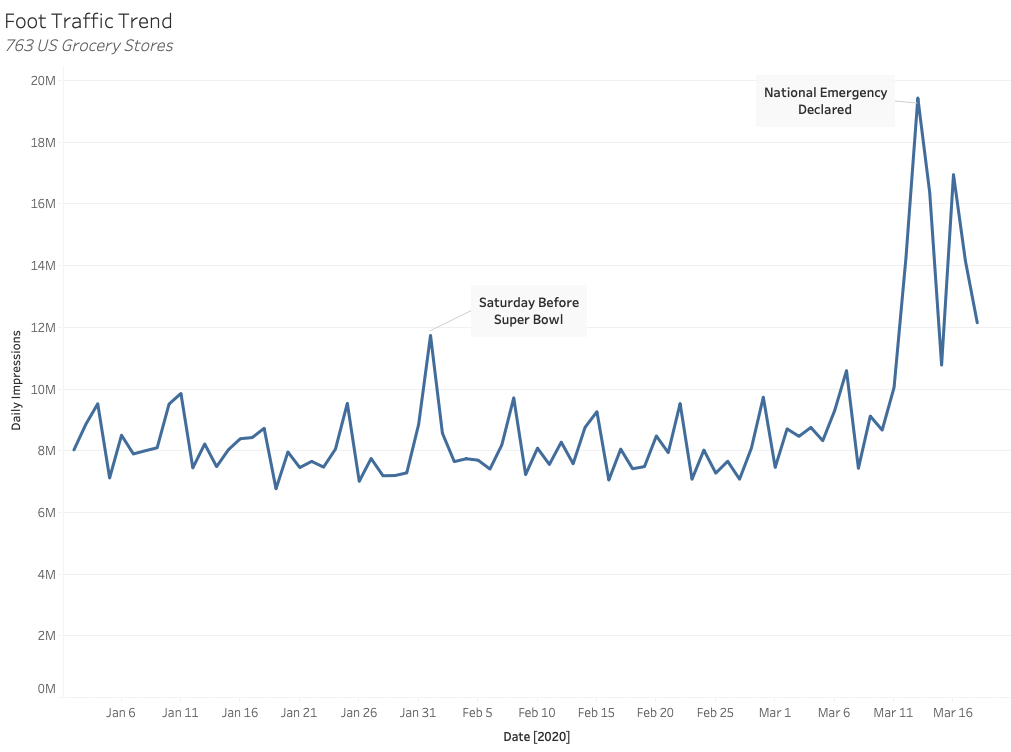

On March 13th, the day the national emergency was declared, we saw a major spike in grocery traffic on our network. To put this in quantitative terms, that day saw 60% more traffic than the Super Bowl, one of the busiest days of the year for grocery stores.

While this data point is an outlier, which reflects the alarming circumstances of that particular day, it is indicative of the impact a crisis can have on consumer behavior.

In times like these, no one data point will give brands a clear picture of how consumer behavior is changing. However, with nearly 3 months of data available since the first case was identified in the U.S., we can start to better understand how shopping habits have changed and potentially will change in the next few months.

Identifying Stages of Consumer Behavior

To simplify the effects of COVID-19 on shopping habits, Nielsen identified 6 consumer behavior thresholds with corresponding event markers based on data from multiple countries. Here's a quick summary of their findings:

#1 Proactive Health-Minded Buying

- Event Marker: minimal localized cases identified

- Shopping Behavior: rise in demand for health and wellness products

#2 Reactive Health Management

- Event Marker: government safety campaigns along with local transmission and/or death

- Shopping Behavior: increased interest in products related to virus containment, public safety, and health

#3 Pantry Preparation

- Event Marker: smaller quarantines start and broader borders closed

- Shopping Behavior: increase in basket sizes and store visits along with rise in demand for shelf-stable products (pantry stockpiling)

#4 Quarantined Living Preparation

- Event Marker: local emergency limitations put in place such as closing schools and public spaces

- Shopping Behavior: increase in out-of-stocks and interest in online shopping*

#5 Restricted Living

- Event Marker: growth in COVID-19 cases paired with more severe lockdown measures

- Shopping Behavior: restrictions in shopping trips* and continued stocking issues

#6 Living a New Normal

- Event Marker: a slow return to normal life as lockdowns are released

- Shopping Behavior: while people commence their daily routines, they continue to put emphasis on health and hygiene

While parts of the U.S. have implemented more or less strict limitations on daily life, the majority of the country appears to be in Stage #5 and potentially rounding the corner towards Stage #6.

A couple questions remain:

- Which of the trends and behaviors in the stages above will perpetuate? Which will continue to evolve in the coming months?

- On a more granular level, will certain products continue to see growth or decline?

We took a deeper look at other sources including data from IRI to identify some of the key trends that may continue even as restrictions are loosened and a semblance of normal life slowly resumes.

*The latest data we've found for grocery shopping still shows the majority of shoppers still going to the store vs. shopping online. There are a lot of misleading headlines around online shopping especially over the last couple months. We think there is definitely a place for online grocery shopping, but from our research found a lot of issues that prevent it from overtaking the in-store experience.

*From what we've seen, while shopping trips might be lower in frequency, basket size has increased. We're expecting both of these to revert to previous averages in the next 6 months as the economy reopens.

Major Trends for CPG Brands in Grocery

DIY Gaining Ground

As consumers find themselves with more free time on their hands, many have picked up a hobby or learned a new skill. Therefore, it's not so surprising that the flour or yeast at your local grocery store is sold out along with toiler paper.

Not only are we seeing a rise in baking, but consumers are also beginning to give themselves haircuts. With the forced closure of beauty and hair salons, there is no other choice for desperate consumers. The trend in at-home beauty is reflected in IRI's CPG Demand Index for Grocery, which shows boosts in demand (compared to a year ago) for Beauty categories such as Personal Cleansing, Grooming Supplies, and Hair Care since the National Emergency was declared.

We're skeptical about whether people will continue cutting their own hair when salons reopen, but do wonder if consumers will continue engaging in their newfound hobbies. A quick look at IRI's data from the last couple weeks reveals that baking items have continued to generate more sales in grocery stores than in previous years, but the trend is slowly declining. We're predicting that people have either stocked up on baking supplies in previous weeks or their new DIY hobbies are merely temporary distractions that will fade over time.

The Meal Prep Mentality

Over the last couple months, consumers have been forced to think longer term when it comes to their meals. Not surprisingly, the convenience of frozen food became apparent to existing and new shoppers of the category who are interested in limiting grocery trips or the effort needed to prepare a meal at home.

According to the American Frozen Food Institute (AFFI) 70% of frozen food shoppers have increased the amount of frozen food they purchase since the beginning of the pandemic. While the increase in frozen food sales has fallen to 30-35% in April compared to 94% in mid-March, the category has seen a potentially permanent expansion in their customer base. Gen Z shoppers and Baby Boomers, who abandoned frozen foods during the age of TV dinners, are conveying a new interest in frozen foods.

A look at IRI's data from the last few weeks shows that frozen food has continued to exhibit some of the highest demand levels vs. a year ago. Consumers are grading frozen food as high on the convenience and quality scales as well as indicating that they'll buy a lot more (18%) or somewhat more (32%) frozen foods in the next few months. Whether or not consumers are true to their word, we see an opportunity for frozen food brands to tailor their marketing strategies to better target these newly adopted consumer segments and establish brand loyalty.

Elevated Hygiene and Health Awareness

Probably the greatest shockwave in consumer behavior has been seen by the Home Care category, which includes popular cleaning supplies. Check out IRI's visualization of "Out of Stock Levels for Top Selling Sub Categories by Market Area in U.S" and filter by "Cloth All Purpose Cleaner." You might not be surprised to see that regions with available data have out-of-stock levels of more than 40%.

Home Care products have continued to generate high demand in grocery stores compared to last year. Proctor & Gamble executives are predicting that even as daily life resumes, consumers' health conscious habits will stick. Recent research from Capgemini further validates this claim by revealing 77% of consumers intend to be more conscientious about health, safety, and cleanliness post-pandemic.

The demand for Home Care products is likely here to stay for the foreseeable future as consumers have adopted new standards for hygiene (noted in Nielsen's Stage #6). We see this behavioral change as an opportunity for established brands to continue building equity and potentially introduce new products into the market to meet the increased needs of consumers.

Shaking Up Brand Loyalty

A little over a week after the national emergency declaration on March 23rd consumers reported that they were unable to get 40% of the items on their grocery shopping list. While our initial assumption was that consumers would be more loyal to brands they know and trust in times of uncertainty, the data seems to indicate that availability has played a larger role than brand loyalty.

A study by Shopkick confirmed that 85% of consumers claim that brand names are not important during a time of crisis. With a shortage of essential items, consumers are willing to try new brands (both national and private label) rather than going home empty-handed.

So, will consumers stay loyal to new brands they tried as an alternative? Once again, we were surprised to find that studies indicate as many as 35% to 45% of consumers claim they will continue purchasing a new national brand they tried due to product availability.

Our recommendation for established brands is to focus on keeping products in stock (easier said than done) and offer promotions to encourage price conscious consumers to stick with their brand even in difficult times.

To sum up our findings, it seems that consumer behavior towards frozen foods and home care could be permanent or at least stick for the next few months. On the other hand, we're still trying to understand whether new consumer behavior trends tied to DIY related products such as flour and yeast will remain or if these were temporary time fillers. To maintain loyalty, brands should be focused on keeping their products in stock and top of mind for consumers, while also meeting loyal cost-conscious consumers with appropriate promotions.

Interested in staying top of mind to grocery shoppers?

Learn More

![[Report] In-Store Retail Media: The Key to Driving Incremental Reach for Brands](/content/images/2025/05/GTV-Incremental-Study-1.jpg)